Supply Chain Earthquake! In-Depth Analysis of the Nexperia Takeover and Material Price Alert (TrustCompo Exclusive)

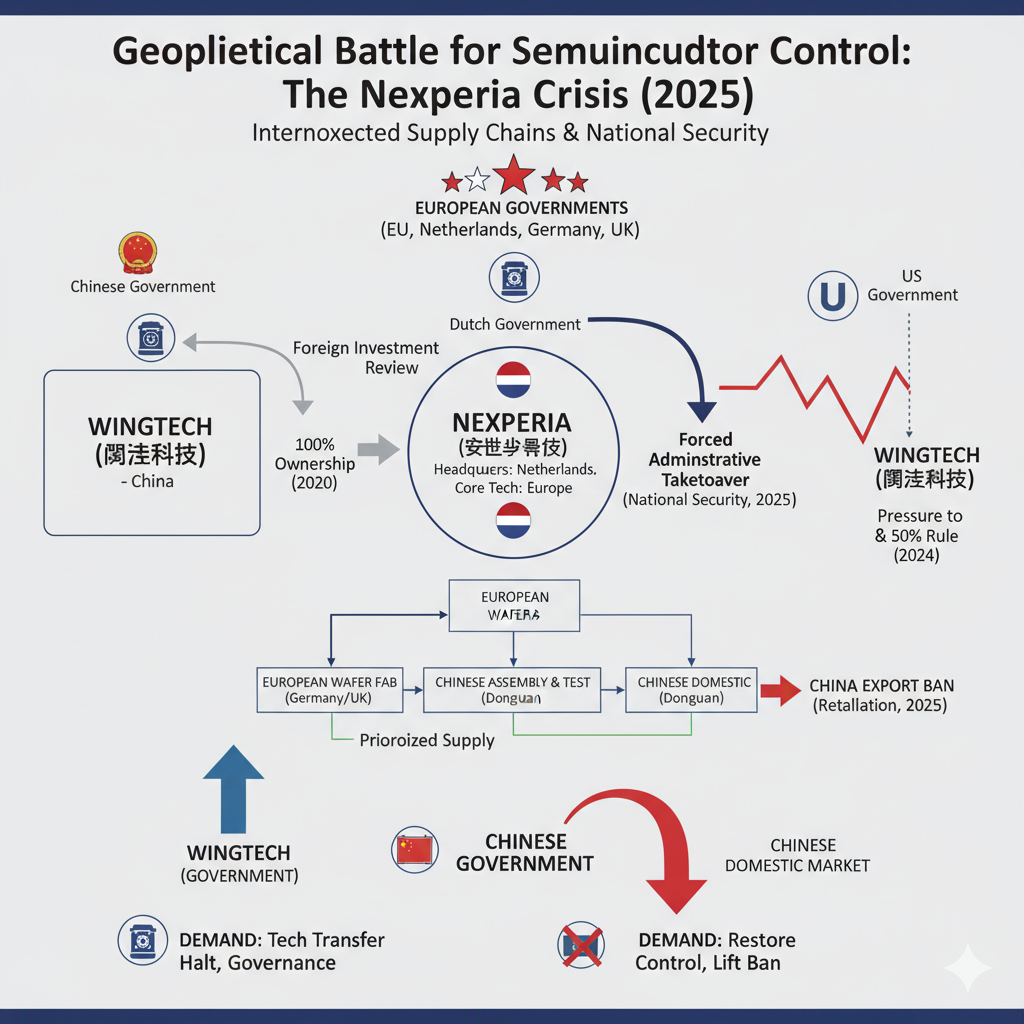

The Nexperia incident represents the most disruptive geopolitical risk to hit the global semiconductor supply chain in recent years. This global leader in basic electronic components has overnight found itself in the dual predicament of legal receivership and international counter-sanctions. For electronic component traders and downstream industrial and automotive customers, understanding the essence of this "takeover and counter-sanction" game, the actual supply chain bottlenecks, and the impact on material supply and market prices is crucial. Based on an in-depth analysis of Nexperia's supply chain, legal status, and technological barriers, this article provides the clearest possible risk assessment for your procurement decisions.

Background of the Incident

Around October 2025, the Dutch government invoked special Cold War-era legislation (the Goods Availability Act) to implement a mandatory administrative takeover (or global operations freeze) of Nexperia, citing national security concerns. This marks the highest-level targeted action taken by a European country since Wingtech Technology was placed on the U.S. Entity List.

- The global assets and operational autonomy of Nexperia (whose parent company is China's Wingtech Technology Holding) were frozen, and procedures were initiated to dismiss the Chinese management team and suspend Wingtech Technology's control.

- The Dutch side stated the move was to prevent the loss of company technology and production capacity, denying it was targeting China and instead citing management issues.

- It is widely believed that this is related to the escalating Sino-US tech competition, geopolitical rivalry, and the impact of the U.S. policy of technology containment against China.

- Subsequently, China's Ministry of Commerce quickly responded with counter-sanctions, announcing export controls on specific finished components and assemblies produced by Nexperia's subsidiaries and subcontractors within China.

Nexperia

Nexperia is a world-leading supplier of discrete, logic, and power MOSFET devices, a "long-tail" component giant in the electronics industry. Its products are widely used in automotive, industrial, and consumer electronics, forming the foundation of all electronic designs.

Legal Status and Business Core:

- Nexperia is a foreign enterprise (a Dutch company). Although Nexperia's equity is controlled by China's Wingtech Technology (through a Chinese consortium), it remains a foreign enterprise in the legal sense, specifically a Dutch company.

- Registration and Legal Entity: Nexperia's legal registered address is in Nijmegen, Netherlands.

- Corporate Governance: It must comply with Dutch company law and regulatory requirements. This is the legal basis upon which the Dutch government was able to seize control (freeze control) citing "national security."

Business Background:

Nexperia was established as an independent company after NXP sold its Standard Products Division in 2017. This product line focuses on manufacturing:

- Discrete devices (e.g., diodes, transistors)

- Logic chips

- Power MOSFETs (especially small-signal devices for automotive and industrial use)

In short, NXP spun off its non-core but high-volume and crucially important basic electronic component business line.

Wingtech Technology

Wingtech Technology is a Chinese A-share listed company with core businesses in product integration (ODM) and semiconductors. Through a complex transaction structure, Wingtech completed its full acquisition of Nexperia between 2019 and 2020. Nexperia's semiconductor business accounts for half of Wingtech's revenue and is its core strategic asset for transitioning to the high-value industrial chain.

Current Situation between China, the U.S., and Europe

The Nexperia incident is the latest escalation in the geopolitical contest between China, the U.S., and Europe in the semiconductor sector. The U.S. placement of Wingtech on the "Entity List" and the expansion of the "Foreign Direct Product Rule" are the direct external factors leading to the Dutch government's intervention. The Dutch takeover order aims to protect Europe's critical technology and supply chain "de-risking"; the Chinese export controls are a reciprocal and precise countermeasure, directly cutting off Nexperia's global supply, with the aim of forcing the Dutch side to restore Nexperia's normal governance structure through legal and diplomatic channels. This contest has moved from technology transfer to mutual supply chain strangulation.

Why Wingtech Technology Cannot Migrate the Technology

Wingtech Technology certainly has the motivation to integrate Nexperia's technology with Chinese production capacity, but such a "technology migration" or "local substitution" plan faces enormous time, technical, and political obstacles:

Insufficient Reliability and Professionalism

While the manufacturing process is not the issue, domestic wafer foundries lack sufficient reliability and specialization.

- Automotive Grade Standard (AEC-Q100/101/200): Nexperia's core advantage lies in its strict automotive-grade certification. Automotive chips must operate stably for over a decade in extreme temperature, humidity, and vibration environments, representing the highest test of design, manufacturing process, and packaging technology. While many domestic foundries can produce similar devices, achieving full automotive certification requires several years.

- IDM Vertical Integration: Nexperia operates on an IDM (Integrated Device Manufacturer) model, meaning it designs, manufactures wafers, and performs packaging/testing itself. This results in highly optimized processes, yield rates, and product performance. To replace it requires not only mimicking wafer manufacturing but also replicating its unique process flow and packaging technology.

- High Voltage, High Current Design: Power devices (MOSFETs, IGBTs, etc.) require special processes to handle high voltage and high current, which differs significantly from digital logic chip manufacturing and demands professional power semiconductor production lines.

Challenge Factors

| Challenge | Description | Difficulty to Mitigate |

|---|---|---|

| Certification Barrier | Long automotive-grade certification cycle, high customer switching costs | Extremely High (requires 1-3 years) |

| Technical IP | Core wafer processes and IP are located in Europe, protected by local laws | Extremely High (restricted by Dutch government administrative order) |

| Process Replication | High difficulty in replicating Nexperia's unique IDM high-yield, high-reliability process | High |

Challenges of Technology Acquisition and Intellectual Property

As the majority shareholder, Wingtech Technology is entitled to know Nexperia's technical details, but "migrating" the technology to factories in China for mass production replacement faces significant challenges:

- Geographical Nature of Intellectual Property (IP):

- Nexperia's core technology, R&D teams, and many wafer manufacturing patents are registered in Europe (Netherlands, Germany, UK).

- This intellectual property is strictly protected by local laws.

- Technology is "People" and "Process":

- Semiconductor manufacturing technology is not just blueprints; it also includes unique process flows, equipment parameters, material formulations, and the accumulated experience of highly specialized engineering teams.

- Transferring this "soft" knowledge and core talent en masse is extremely difficult and highly likely to provoke backlash from local governments and employees.

- Special Processes in European Factories:

- Nexperia's wafer fabs in Germany and the UK use highly optimized European processes to manufacture automotive-grade chips.

- Replicating the same yield and automotive reliability on Chinese production lines requires a long period of alignment and certification.

Political and Regulatory Resistance

This is the biggest obstacle to technology migration. When Wingtech acquired Nexperia, it was subject to strict foreign investment reviews and had to make commitments in exchange for approval:

- Review Conditions: When approving the acquisition, the Dutch and UK governments likely required Wingtech to commit to not transferring key technology and intellectual property out of Europe, to protect local employment, supply chain, and national security.

- "Technology Transfer" is the Reason for Dutch Action: The core reason the Dutch government issued the ministerial order and froze Nexperia's global operations is the "concern that key technology might be transferred to the Chinese parent company," posing a threat to European economic security.

- Chain Reaction of U.S. "Foreign Direct Product Rule":

- Wingtech Technology has been placed on the U.S. "Entity List."

- The subsequent U.S. "50% Foreign Direct Product Rule" means Nexperia, being over 50% owned by Wingtech, could also be subject to restrictions.

- This makes any adjustment involving technology or the supply chain highly sensitive and difficult.

Pre-Event Technology Migration Progress and Limitations

Wingtech Technology certainly had the motivation to integrate Nexperia's technology with its domestic production capacity after the acquisition to achieve synergy and reduce reliance on Europe.

- Wingtech's Plan:

- Wingtech Technology has semiconductor production bases in China (e.g., in Lingang).

- It planned to combine Nexperia's advanced packaging technology and some chip design with domestic manufacturing capabilities.

- Executive Conflict:

- News reports indicated that before the Dutch government intervened, several foreign executives at Nexperia had conflicts with the Wingtech side (Zhang Xuezheng).

- The immediate freezing of the Chinese CEO's corporate accounts after the court action reflects internal management disputes over technology and control.

- Administrative Order Restrictions:

- The Dutch ministerial order explicitly requires Nexperia and its 30 global entities not to make any "adjustments to its assets, intellectual property, business, or personnel" for one year.

- This directly halted all potential technology transfer and resource integration plans.

To summarize, Wingtech Technology currently faces the following issues:

| Issue Dimension | Current Status Description | Specific Impact |

|---|---|---|

| Manufacturing | - European wafer fabs (Germany/UK) and Asian assembly & test (China/Malaysia/Philippines) remain operational - "Routine production processes can continue" | - Basic capacity is temporarily stable - But long-term technology upgrades and expansion plans are blocked |

| Corporate Governance | - Dutch government enforced takeover of governance - Independent third party appointed to hold shares - Wingtech-appointed CEO suspended | - Loss of actual control over Nexperia - Cannot make strategic adjustments or resource allocation - Technology transfer plans completely halted |

| Sales System | - Dutch freeze order restricts global sales decisions - China implements export controls on "China-packaged" products | - European customers face supply disruption risk - Global supply chain faces "China-packaged" bottleneck - Overseas market prices surge |

| Cash Flow | - Right to economic profit (dividends) retained - But profit distribution decision rights are restricted | - Difficult to obtain operating profit dividends in the short term - Potential cash flow pressure - Listed company financial reports will be significantly affected |

| Technology Development | - Dutch injunction prohibits any technology adjustments - R&D team management transferred to a third party | - Process iteration and product R&D stagnate - Local Chinese substitution plan blocked - Uncertainty regarding auto-grade certification renewal |

End-Customer Procurement Risk Analysis

Nexperia's IDM Model

Nexperia is an IDM (Integrated Device Manufacturer), and its manufacturing chain is divided into two main parts:

| Phase | Production Line Type | Main Locations (Core Technology Location) | Function |

|---|---|---|---|

| Frontend Manufacturing | Wafer Fabs | Hamburg, Germany; Manchester, UK | Manufacturing wafers (the core part of the chip), the most concentrated area of technology and IP |

| Backend Manufacturing | Assembly & Test (A&T) Fabs | Dongguan, China; Seremban, Malaysia; Cabuyao, Philippines | Cutting, packaging, and testing wafers to form the final component. The Dongguan factory is Nexperia's largest small-signal component factory. |

The Dutch government is not aiming to directly seize Nexperia's sales profit. Its economic motivation focuses more on "maintaining the local ecosystem":

- Protecting high-value employment: Ensuring that Nexperia's headquarters, R&D centers, and high-salary engineering jobs in the Netherlands are not lost.

- Ensuring stable national tax revenue: Ensuring Nexperia, as a large multinational company, continues to pay corporate income tax in the Netherlands.

- Protecting supply chain status: Ensuring Nexperia's European wafer fabs (Germany, UK) can continue to serve as core nodes in the European supply chain.

Procurement for Domestic End-Customers (Use within China)

| Path/Scenario | Procurement Risk |

|---|---|

| Europe Wafer → China A&T → Domestic Sales | Short-term: Existing inventory and wafers in transit can support supply. Wingtech is attempting "independent self-rescue," prioritizing the domestic market. Long-term: If European wafer fabs (under Dutch receivership) subsequently stop supplying, production will halt once raw materials are exhausted. Medium-High Risk. Short-term supply is manageable, but long-term supply depends heavily on the continued flow of European wafers, with extreme uncertainty. |

| Europe Wafer → Southeast Asia A&T → Domestic Sales | Theoretically feasible, but capacity is limited. Southeast Asian factories cannot quickly take over all orders from Dongguan, failing to meet the massive domestic demand. Low Risk, but Capacity Restricted. |

Procurement for Foreign End-Customers (Use outside China)

| Path/Scenario | Procurement Risk |

|---|---|

| Europe Wafer → China A&T → Export Abroad | The most direct source of supply disruption. China's export controls cut off the most important "export" link in Nexperia's global supply chain. Extremely High Risk (Supply has halted). Customers must urgently seek alternative solutions. |

| Europe Wafer → Southeast Asia A&T → Export Abroad | Indirectly affected, but currently the main hope. Southeast Asian factory capacity and product mix cannot quickly replace Dongguan, facing severe capacity bottlenecks and extended lead times. Medium-High Risk. Supply is not cut off, but faces severe capacity bottlenecks and extended lead times. |

Global Supply Chain Under Severe Shock

According to TrustCompo's market monitoring data, Nexperia materials exhibiting the following "High Risk" characteristics have shown significant price volatility and lead time extensions:

| Characteristic | Explanation | Market Impact |

|---|---|---|

| 1. European Wafer (Manufactured in Germany/UK) | Core raw material of the chip, supply source uncertainty exists | Uncertainty at the source of supply provides the fundamental basis for price speculation |

| 2. China Dongguan A&T (Assembly & Test) | The "bottleneck" in the supply chain. China's export controls specifically target finished goods "exported from China." | These materials cannot be shipped abroad**, directly leading to zero supply in overseas markets**, the direct cause of price surges |

| 3. Used by Foreign End-Customers (Especially Automakers) | Inelastic demand. Customers lack short-term ability to switch orders and can only purchase at high prices in the spot market. | Demand-side inelasticity triggers price surges to 2-3 times the normal price in a short period. |

The following are the main product series affected by the China A&T situation and their price changes (data as of October 25th). Prices are based on spot market data and are for reference only.

1. 74HC Series Logic Chips

Product Introduction: The 74HC series is Nexperia's High-Speed CMOS logic chip, using silicon-gate CMOS process, featuring low power consumption, high noise immunity, 2-6V operating voltage, and TTL level compatibility. Widely used in industrial control, automotive electronics, and consumer electronics.

Representative Models:

- 74HC595D (8-bit Serial-In/Parallel-Out Shift Register)

- 74HC165D (8-bit Parallel-In/Serial-Out Shift Register)

- 74HC4051PW (8-channel Analog Multiplexer/Demultiplexer)

Price Change: 74HC595D rose from 0.04 USD to 0.07 USD (an increase of 75%), with lead times extended to 12-16 weeks.

2. Power MOSFETs

Product Introduction: The BUK9 series is Nexperia's classic automotive-grade Power MOSFET, utilizing TrenchMOS technology, featuring low ON-resistance ($R_{DS(on)}$) and high switching frequency characteristics. It is AEC-Q101 certified, mainly used for in-vehicle power management, motor drive, etc.

Affected Models:

- BUK9219-55A (Discontinued, originally used in 48V mild hybrid systems)

- BUK9K29-100E (Replacement model, 100V/55A)

- BUK9K17-60E (60V/17A, used for ECU power)

Price Change: BUK9219-100E spot price increased by 40-60%.

3. ESD Protection Devices

Product Introduction: The PESD series are automotive-grade ESD protection devices, utilizing small packages like SOT23, with response times $<1\text{ns}$, compliant with ISO7637-2 standard, used to protect CAN bus, LIN bus, and other in-vehicle communication interfaces.

Key Models:

- PESD1LIN (LIN Bus specific)

- PESD24VL1BA (24V system protection)

- PESD2CAN (Dual-channel CAN bus protection)

Supply Impact: Automotive CAN node module production faces shortage risks.

4. Diode Products

Product Introduction: BAV99 is a high-speed switching dual diode, utilizing SOT23 package, with a reverse recovery time of only $4\text{ns}$, suitable for high-frequency rectification and signal conditioning circuits.

Representative Models:

- BAV99 (Dual Diode, 100V/200mA)

Market Status: Lead times extended to 8-10 weeks, with a spot premium of 30%.

5. Automotive-Grade MOSFETs

Product Introduction: These MOSFETs are all AEC-Q101 certified, featuring high reliability ($\text{FIT Rate} < 1$) and wide temperature range ($-55^\circ\text{C}$ to $175^\circ\text{C}$), used in critical systems like engine control and LED drivers.

Key Models:

- BC817-40 (NPN General Purpose Transistor)

- BCX56-16-Q (PNP Power Transistor)

- PMV100EPA (100V/75A Smart Power Module)

- PMV65XP (65V/40A MOSFET)

Industry Impact: ECU module production faces pressure from extended lead times and rising costs.

TrustCompo Electronic Was Prepared

To help customers cope with this sudden "supply chain storm," TrustCompo Electronic has activated its emergency supply chain assurance mechanism. We commit to:

- Stable Spot Supply: For all Nexperia materials mentioned above that are affected by China's export controls and extended lead times, we have certified, reliable inventory or alternative sources to ensure your production lines are not interrupted.

- Professional Alternatives: Providing AEC-Q101 certified domestic or international brand alternatives, assisting customers in quickly completing material validation (Qualification).

- Price Risk Management: Avoiding spot market premiums and offering competitive long-term supply prices.

Act Now: Please contact your dedicated procurement consultant at service@trustcompo.com for the latest Nexperia material quotes and supply chain assurance solutions.